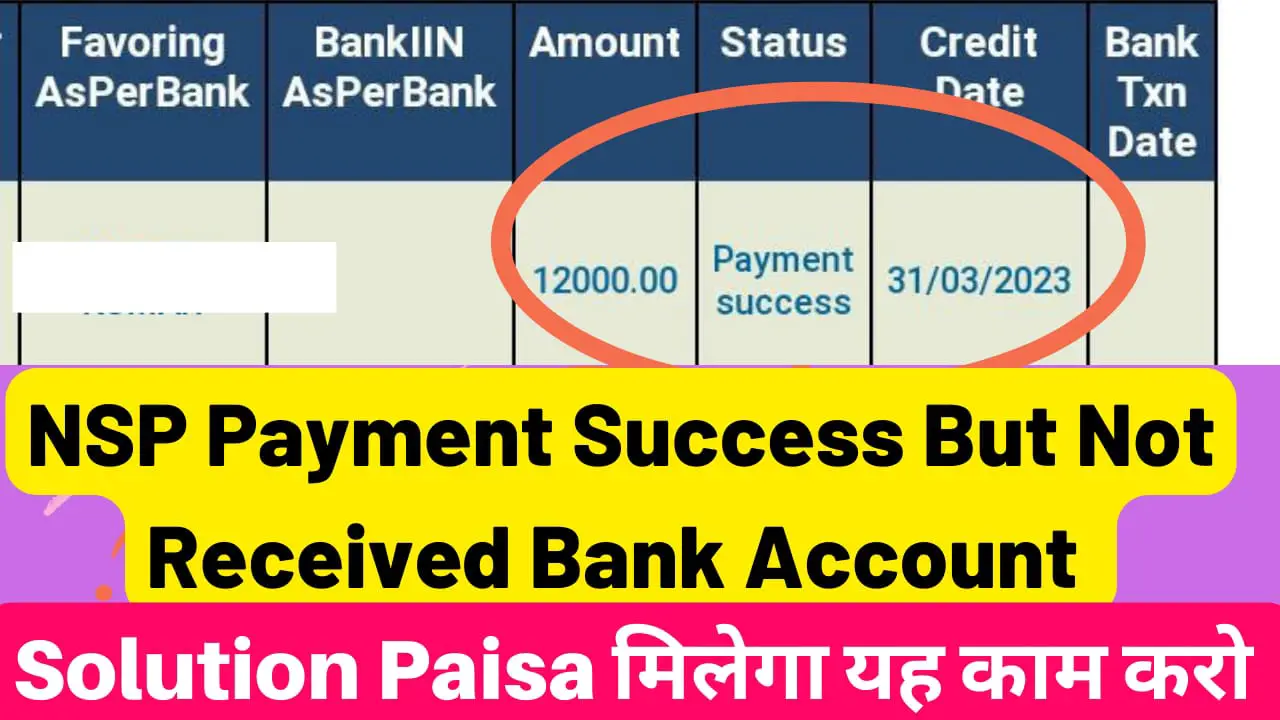

It can be frustrating to see an NSP payment marked successful but not reflected in your bank account. This situation can arise for various reasons, but there are steps you can take to resolve it. Here’s a comprehensive guide to understanding the potential causes and finding solutions:

Understanding the Delay

-

Bank Working Days: Ensure you consider bank working days. If the payment is initiated on a weekend or holiday, it might not reflect in your account until the next business day. Banks typically process transactions during their operational hours.

-

Technical Glitch: Occasionally, technical glitches within the NSP system or your bank’s server can delay the credit. These issues are usually resolved quickly, but a slight delay is possible.

-

Account Verification: Payments might be held if your bank account lacks proper KYC (Know Your Customer) verification or isn’t linked to your Aadhaar card (a unique identification number in India). Ensure your bank account details are up-to-date and KYC compliant.

-

Incorrect Account Information: Double-check if you provided the correct bank account information during the NSP application process. Any discrepancy in account number, IFSC code (Indian Financial System Code), or beneficiary name can cause delays or even payment rejection.

Resolving the Issue

-

Wait for Bank Working Days: If the payment was initiated recently, especially on a non-working day, allow 1-2 business days for the amount to reflect in your account.

-

Verify Transaction History: Log in to your online banking portal or mobile app and check your transaction history for the specific date of the NSP payment. This can confirm if the transfer is pending or already completed.

-

Contact NSP Helpdesk: If the payment doesn’t show up after a reasonable wait time (typically 2-3 business days), reach out to the NSP Helpdesk. Here are some ways to contact them:

- NSP Helpdesk Phone Number: Locate the specific NSP Helpdesk phone number on the official NSP website.

- NSP Helpdesk Email: The NSP website should also have an email address dedicated to handling payment inquiries.

- NSP Online Help Portal: Many NSPs might have an online help portal where you can submit a support ticket regarding your payment issue.

When contacting the Helpdesk, have the following information ready:

* Your Name and Reference Number (if provided by NSP) * Date of NSP Payment Initiation * Transaction Reference Number (if available) * Bank Account Details (account number & IFSC code) used for receiving the payment -

Contact Your Bank: If the NSP Helpdesk confirms the successful payment from their end, contact your bank’s customer care department. Explain the situation and provide details about the NSP payment. Your bank can investigate any potential hold-ups on their side.

-

Gather Documentation: While contacting the NSP Helpdesk or your bank, keep copies of relevant documents handy. This might include:

- Screenshot or printout of the NSP payment success confirmation

- Bank account details (statement or copy of your bank passbook)

- Any communication received from NSP or your bank regarding the payment

Additional Tips

- Track the Issue: Maintain a record of your communication with the NSP Helpdesk and your bank. Note down dates, names of representatives spoken to, and any reference numbers provided. This helps create a clear timeline if the issue persists.

- Stay Calm: While delays can be frustrating, remain calm and polite while interacting with the NSP Helpdesk or your bank. A professional approach will expedite the resolution process.

- Escalate if Needed: If, after reasonable follow-up, the issue remains unresolved, consider escalating the matter to higher authorities within the NSP or your bank.

Preventing Future Issues

- Double-check Bank Details: Before submitting any application requiring bank account information, meticulously check and re-check the account number, IFSC code, and beneficiary name for accuracy.

- Maintain Updated KYC: Ensure your bank account is KYC compliant. This verification process helps prevent fraud and ensures smooth transactions.

- Link Aadhaar (if applicable): If applicable, link your Aadhaar card to your bank account. This can streamline various financial processes, including receiving payments.

By following these steps and maintaining accurate information, you can effectively resolve delays in receiving NSP payments and ensure a smoother experience in the future. Remember, timely communication and keeping records are crucial in getting your issue addressed promptly.